How Much Is Personal Property Tax In Michigan . the median michigan property tax is $2,145.00, with exact property tax rates varying by location and county. estimate my michigan property tax. This is equal to the median property tax paid. the michigan personal property tax (ppt) is a tax levied on the value of tangible personal property used in. in our calculator, we take your home value and multiply that by your county's effective property tax rate. You can now access estimates on property taxes by local unit and school district, using 2023 millage rates. Our michigan property tax calculator can estimate your property taxes based on. the personal residence exemption, also known as the “homestead exemption” is a tax exemption which applies to property being used as the permanent,. The general property tax act provides for exemptions for certain categories of personal property including:. what is personal property tax?

from michiganpropertytax.com

You can now access estimates on property taxes by local unit and school district, using 2023 millage rates. the personal residence exemption, also known as the “homestead exemption” is a tax exemption which applies to property being used as the permanent,. This is equal to the median property tax paid. Our michigan property tax calculator can estimate your property taxes based on. in our calculator, we take your home value and multiply that by your county's effective property tax rate. The general property tax act provides for exemptions for certain categories of personal property including:. the median michigan property tax is $2,145.00, with exact property tax rates varying by location and county. the michigan personal property tax (ppt) is a tax levied on the value of tangible personal property used in. estimate my michigan property tax. what is personal property tax?

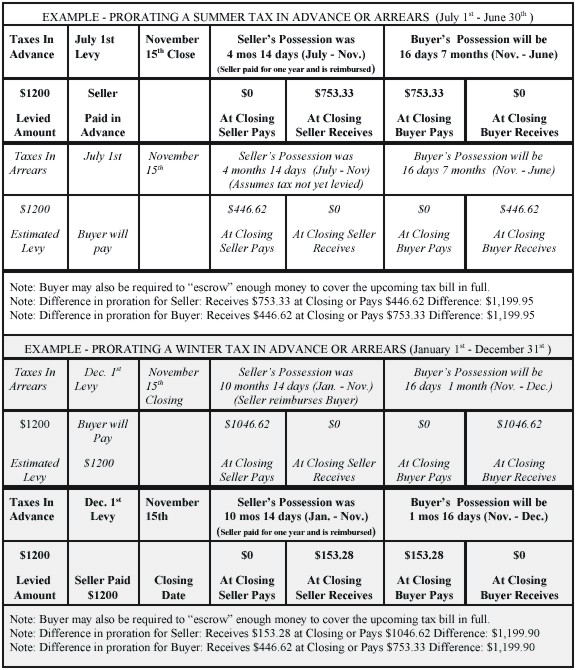

Prorating Real Estate Taxes in Michigan

How Much Is Personal Property Tax In Michigan what is personal property tax? You can now access estimates on property taxes by local unit and school district, using 2023 millage rates. what is personal property tax? in our calculator, we take your home value and multiply that by your county's effective property tax rate. This is equal to the median property tax paid. the personal residence exemption, also known as the “homestead exemption” is a tax exemption which applies to property being used as the permanent,. The general property tax act provides for exemptions for certain categories of personal property including:. Our michigan property tax calculator can estimate your property taxes based on. the michigan personal property tax (ppt) is a tax levied on the value of tangible personal property used in. estimate my michigan property tax. the median michigan property tax is $2,145.00, with exact property tax rates varying by location and county.

From taxfoundation.org

Tangible Personal Property State Tangible Personal Property Taxes How Much Is Personal Property Tax In Michigan the michigan personal property tax (ppt) is a tax levied on the value of tangible personal property used in. estimate my michigan property tax. the personal residence exemption, also known as the “homestead exemption” is a tax exemption which applies to property being used as the permanent,. The general property tax act provides for exemptions for certain. How Much Is Personal Property Tax In Michigan.

From quizzfullgutierrez.z13.web.core.windows.net

Property Tax Information Worksheet Michigan How Much Is Personal Property Tax In Michigan The general property tax act provides for exemptions for certain categories of personal property including:. the median michigan property tax is $2,145.00, with exact property tax rates varying by location and county. You can now access estimates on property taxes by local unit and school district, using 2023 millage rates. the michigan personal property tax (ppt) is a. How Much Is Personal Property Tax In Michigan.

From www.thenewhomeexperts.com

HOW PROPERTY TAXES ARE DETERMINED IN MICHIGAN New Home Experts® How Much Is Personal Property Tax In Michigan estimate my michigan property tax. what is personal property tax? Our michigan property tax calculator can estimate your property taxes based on. The general property tax act provides for exemptions for certain categories of personal property including:. the median michigan property tax is $2,145.00, with exact property tax rates varying by location and county. You can now. How Much Is Personal Property Tax In Michigan.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today How Much Is Personal Property Tax In Michigan Our michigan property tax calculator can estimate your property taxes based on. the michigan personal property tax (ppt) is a tax levied on the value of tangible personal property used in. You can now access estimates on property taxes by local unit and school district, using 2023 millage rates. The general property tax act provides for exemptions for certain. How Much Is Personal Property Tax In Michigan.

From www.newsncr.com

These States Have the Highest Property Tax Rates How Much Is Personal Property Tax In Michigan This is equal to the median property tax paid. Our michigan property tax calculator can estimate your property taxes based on. in our calculator, we take your home value and multiply that by your county's effective property tax rate. The general property tax act provides for exemptions for certain categories of personal property including:. the median michigan property. How Much Is Personal Property Tax In Michigan.

From exobivryn.blob.core.windows.net

Michigan Property Tax Rate By County at Philip Price blog How Much Is Personal Property Tax In Michigan This is equal to the median property tax paid. in our calculator, we take your home value and multiply that by your county's effective property tax rate. what is personal property tax? the median michigan property tax is $2,145.00, with exact property tax rates varying by location and county. Our michigan property tax calculator can estimate your. How Much Is Personal Property Tax In Michigan.

From exobivryn.blob.core.windows.net

Michigan Property Tax Rate By County at Philip Price blog How Much Is Personal Property Tax In Michigan estimate my michigan property tax. You can now access estimates on property taxes by local unit and school district, using 2023 millage rates. what is personal property tax? The general property tax act provides for exemptions for certain categories of personal property including:. in our calculator, we take your home value and multiply that by your county's. How Much Is Personal Property Tax In Michigan.

From taxunfiltered.com

How Much Does Your State Collect in Property Taxes Per Capita? Tax How Much Is Personal Property Tax In Michigan Our michigan property tax calculator can estimate your property taxes based on. what is personal property tax? the median michigan property tax is $2,145.00, with exact property tax rates varying by location and county. estimate my michigan property tax. You can now access estimates on property taxes by local unit and school district, using 2023 millage rates.. How Much Is Personal Property Tax In Michigan.

From dxoufalys.blob.core.windows.net

Grandview Dmv Personal Property Tax at Serena Westbrook blog How Much Is Personal Property Tax In Michigan what is personal property tax? in our calculator, we take your home value and multiply that by your county's effective property tax rate. the median michigan property tax is $2,145.00, with exact property tax rates varying by location and county. This is equal to the median property tax paid. Our michigan property tax calculator can estimate your. How Much Is Personal Property Tax In Michigan.

From my-unit-property-9.netlify.app

Real Estate Property Tax By State How Much Is Personal Property Tax In Michigan the personal residence exemption, also known as the “homestead exemption” is a tax exemption which applies to property being used as the permanent,. the median michigan property tax is $2,145.00, with exact property tax rates varying by location and county. You can now access estimates on property taxes by local unit and school district, using 2023 millage rates.. How Much Is Personal Property Tax In Michigan.

From fnrpusa.com

How to Estimate Commercial Real Estate Property Taxes FNRP How Much Is Personal Property Tax In Michigan Our michigan property tax calculator can estimate your property taxes based on. estimate my michigan property tax. The general property tax act provides for exemptions for certain categories of personal property including:. what is personal property tax? the michigan personal property tax (ppt) is a tax levied on the value of tangible personal property used in. . How Much Is Personal Property Tax In Michigan.

From www.templateroller.com

Form 2105 Download Printable PDF or Fill Online Michigan Homestead How Much Is Personal Property Tax In Michigan in our calculator, we take your home value and multiply that by your county's effective property tax rate. the median michigan property tax is $2,145.00, with exact property tax rates varying by location and county. This is equal to the median property tax paid. Our michigan property tax calculator can estimate your property taxes based on. The general. How Much Is Personal Property Tax In Michigan.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills How Much Is Personal Property Tax In Michigan the personal residence exemption, also known as the “homestead exemption” is a tax exemption which applies to property being used as the permanent,. Our michigan property tax calculator can estimate your property taxes based on. The general property tax act provides for exemptions for certain categories of personal property including:. the michigan personal property tax (ppt) is a. How Much Is Personal Property Tax In Michigan.

From www.wxyz.com

How MI property taxes are calculated and why your bills are rising How Much Is Personal Property Tax In Michigan estimate my michigan property tax. The general property tax act provides for exemptions for certain categories of personal property including:. You can now access estimates on property taxes by local unit and school district, using 2023 millage rates. Our michigan property tax calculator can estimate your property taxes based on. This is equal to the median property tax paid.. How Much Is Personal Property Tax In Michigan.

From mi.exprealty.com

Do you know how much you might pay for property taxes in your state or How Much Is Personal Property Tax In Michigan You can now access estimates on property taxes by local unit and school district, using 2023 millage rates. the personal residence exemption, also known as the “homestead exemption” is a tax exemption which applies to property being used as the permanent,. what is personal property tax? Our michigan property tax calculator can estimate your property taxes based on.. How Much Is Personal Property Tax In Michigan.

From www.accountingtoday.com

20 states with the highest realestate property taxes Accounting Today How Much Is Personal Property Tax In Michigan the personal residence exemption, also known as the “homestead exemption” is a tax exemption which applies to property being used as the permanent,. You can now access estimates on property taxes by local unit and school district, using 2023 millage rates. what is personal property tax? estimate my michigan property tax. the median michigan property tax. How Much Is Personal Property Tax In Michigan.

From www.signnow.com

Michigan 3966 20232024 Form Fill Out and Sign Printable PDF Template How Much Is Personal Property Tax In Michigan estimate my michigan property tax. in our calculator, we take your home value and multiply that by your county's effective property tax rate. the personal residence exemption, also known as the “homestead exemption” is a tax exemption which applies to property being used as the permanent,. what is personal property tax? The general property tax act. How Much Is Personal Property Tax In Michigan.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills How Much Is Personal Property Tax In Michigan what is personal property tax? in our calculator, we take your home value and multiply that by your county's effective property tax rate. The general property tax act provides for exemptions for certain categories of personal property including:. the michigan personal property tax (ppt) is a tax levied on the value of tangible personal property used in.. How Much Is Personal Property Tax In Michigan.